Trump Denies Plans To Fire Federal Reserve Chairman Powell

Table of Contents

Trump's Public Statements and Their Context

The Denial and its Timing

President Trump's denial of plans to remove Chairman Powell needs careful examination. The timing of these statements is crucial. Understanding the context – recent economic indicators, market volatility, and political pressures – provides essential insight.

- Exact quotes from Trump's statements: (Insert verbatim quotes from President Trump's official statements, news conferences, or social media posts denying the firing of Chairman Powell. Properly cite the source.)

- Date and platform of the statement: (Include the precise date and platform – e.g., "In a tweet on October 26, 2023, President Trump stated...")

- Mention any preceding criticisms of Powell made by Trump: (Detail previous instances of public criticism from President Trump targeting Chairman Powell and the Federal Reserve's policies. Examples could include specific criticisms of interest rate hikes or other monetary policy decisions.)

Analyzing Trump's Motives

Why did President Trump issue this denial? Was it a genuine change of heart, a strategic move to soothe volatile markets, a response to growing political pressure, or a combination of factors? Several possibilities warrant consideration.

- Political ramifications of firing Powell: Dismissing the Federal Reserve Chairman would likely trigger significant political backlash, potentially impacting the President's approval ratings and the Republican party's standing.

- Impact on the upcoming election: The economic climate plays a crucial role in shaping voter sentiment. A drastic move like firing Powell could negatively affect the President's chances of re-election.

- Influence of advisors and economic experts: The President's decision-making process is often influenced by the counsel of advisors and economic experts. Their recommendations regarding the potential consequences of dismissing Powell might have played a significant role.

The Implications for the Federal Reserve's Independence

Maintaining Central Bank Autonomy

The independence of the Federal Reserve from political interference is paramount to its effectiveness. Attempts to influence the Fed's decisions through threats or pressure undermine its ability to make objective, data-driven decisions essential for managing the economy.

- Historical precedents of political pressure on the Fed: (Discuss historical examples where political pressure influenced Federal Reserve decisions, emphasizing the negative consequences.)

- Impact on market confidence and investor sentiment: Political interference in the Fed's operations erodes market confidence and investor sentiment, leading to increased volatility and uncertainty.

- Discussion of legal frameworks protecting the Fed's autonomy: (Explore legal provisions and traditions designed to safeguard the Fed's independence from political manipulation.)

Powell's Response and Future Actions

Chairman Powell's response to President Trump's statements (if any) is critical. His actions and the Fed's future policy decisions will significantly influence market confidence and the economic outlook.

- Powell's past statements on the Fed's independence: (Highlight previous statements by Chairman Powell emphasizing the importance of the Fed's independence from political pressure.)

- Analysis of upcoming Fed meetings and potential policy decisions: (Discuss upcoming Federal Reserve meetings and the possible policy decisions that may be made in light of the recent political developments.)

- Discussion of the possible long-term effects on monetary policy: (Analyze how the current political climate might affect the Federal Reserve's long-term monetary policy strategies.)

Market Reactions and Economic Outlook

Impact on Financial Markets

Trump's denial of plans to fire Powell had a measurable impact on financial markets. Analyzing this impact provides insights into investor sentiment and market confidence.

- Stock market performance before and after Trump's statement: (Compare stock market indices before and after the President's statement to determine the market's response.)

- Changes in interest rates and bond yields: (Analyze changes in interest rates and bond yields following the announcement, noting any significant fluctuations.)

- Analysis of market volatility and investor sentiment: (Assess the level of market volatility and investor sentiment before and after the President's denial.)

Economic Forecasts and Uncertainty

The uncertainty surrounding the President's relationship with the Fed chair continues to cast a shadow over economic forecasts.

- Expert opinions on the short-term and long-term economic impacts: (Summarize opinions from economists and financial analysts regarding the potential short-term and long-term effects on the US economy.)

- Discussion of potential risks and opportunities for the US economy: (Discuss potential risks and opportunities for the US economy, considering the ongoing uncertainty.)

- Mention of key economic indicators to watch: (Highlight specific economic indicators to monitor closely to assess the ongoing impact of the situation.)

Conclusion

President Trump's denial of plans to fire Federal Reserve Chairman Powell, while seemingly reassuring, does not fully resolve the underlying tensions and uncertainty. The implications for the Fed's independence, market stability, and the overall economic outlook remain significant. The ongoing political climate requires close monitoring, particularly as it relates to the Federal Reserve's ability to make independent decisions based solely on economic data. The market's reaction, while initially positive, underscores the continued sensitivity surrounding this relationship.

Call to Action: Stay informed about developments concerning the relationship between President Trump and Federal Reserve Chairman Powell. Continue to follow our updates for the latest news and analysis on "Trump Denies Plans to Fire Federal Reserve Chairman Powell" and related topics to understand the evolving economic and political landscape. Understanding this dynamic is critical to navigating the complexities of the current economic environment.

Featured Posts

-

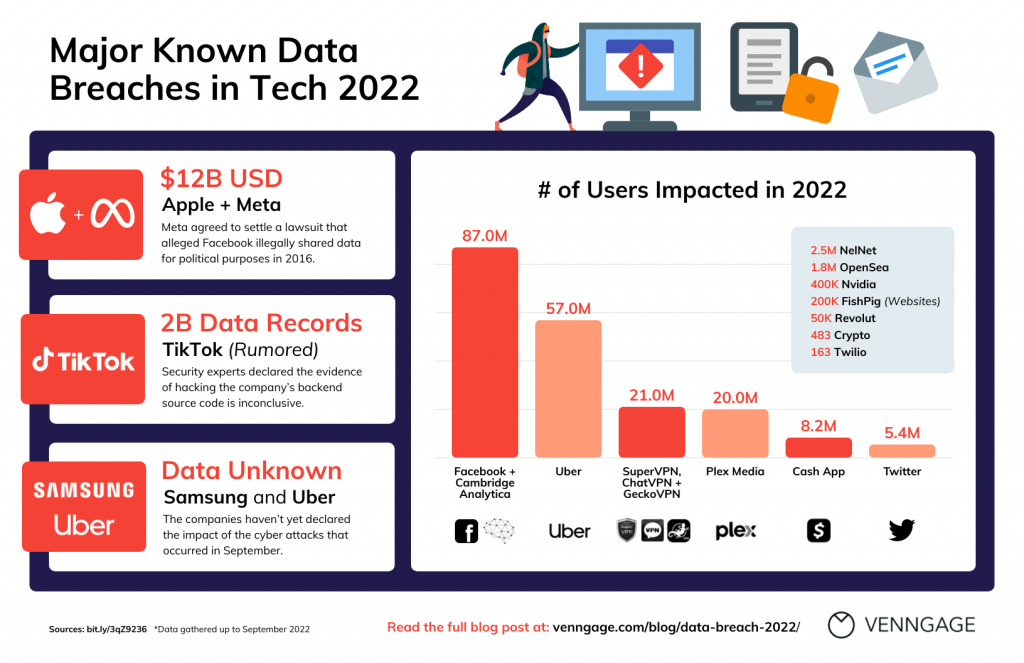

Office365 Data Breach Leads To Millions In Losses Criminal Charges Filed

Apr 24, 2025

Office365 Data Breach Leads To Millions In Losses Criminal Charges Filed

Apr 24, 2025 -

The China Market A Case Study Of Bmw And Porsches Struggles And Adaptations

Apr 24, 2025

The China Market A Case Study Of Bmw And Porsches Struggles And Adaptations

Apr 24, 2025 -

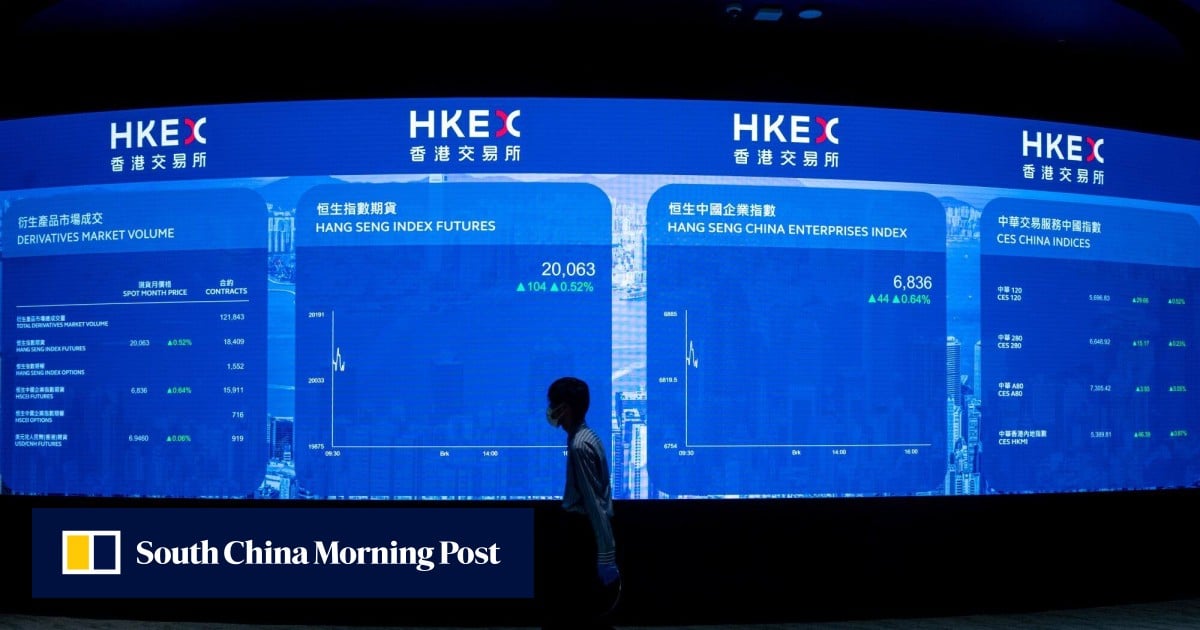

Increased Investment In Chinese Stocks Listed In Hong Kong

Apr 24, 2025

Increased Investment In Chinese Stocks Listed In Hong Kong

Apr 24, 2025 -

Hopes Shocking Twists Liams Pledge To Steffy And Lunas Impact The Bold And The Beautifuls Upcoming Episodes

Apr 24, 2025

Hopes Shocking Twists Liams Pledge To Steffy And Lunas Impact The Bold And The Beautifuls Upcoming Episodes

Apr 24, 2025 -

77 Lg C3 Oled Tv A Comprehensive Look

Apr 24, 2025

77 Lg C3 Oled Tv A Comprehensive Look

Apr 24, 2025