Trump's Proposed Ban On Congressional Stock Trading: A Time Magazine Interview Analysis

Table of Contents

Trump's Stance in the Time Magazine Interview

Trump's proposal for a ban on congressional stock trading, as detailed in his recent Time Magazine interview, represents a strong stance against perceived conflicts of interest within the US government. His call for this ban isn't new; he has voiced concerns about this issue previously. However, the Time Magazine interview offered a renewed focus on the topic, bringing it back into the national conversation.

Specific Quotes from the Interview Supporting His Proposed Ban

While the exact wording may vary depending on the specific transcript, the general sentiment expressed by Trump consistently emphasizes the need for increased transparency and a reduction in the appearance of impropriety. For instance, he might have stated something along the lines of, “It’s a disgrace. Members of Congress shouldn't be able to profit from their positions.” (Note: This is a hypothetical example; replace with actual quotes from the interview if available).

- Key Arguments: Trump likely argued that the ability of Congress members to trade stocks creates an inherent conflict of interest, undermining public trust and potentially influencing legislative decisions for personal gain.

- Potential Benefits (as per Trump): He likely presented the ban as a way to restore faith in government, reduce corruption, and ensure lawmakers focus solely on serving the public interest.

- Specific Examples (if used): Trump may have referenced specific instances of congressional stock trading that he deemed unethical or problematic to further his argument.

Analysis of the Proposed Ban's Potential Impact

Trump's proposed ban on congressional stock trading has significant potential impacts, both positive and negative.

Positive Effects:

- Improved Public Trust: A ban could significantly boost public confidence in government by reducing the perception of corruption and self-dealing. Numerous polls show widespread public distrust in Congress, and addressing this issue could help rebuild that trust.

- Reduced Potential for Conflicts of Interest: Eliminating the ability to profit from insider information or legislative actions directly reduces the potential for conflicts of interest. This would promote fairer and more equitable policymaking.

- Stronger Ethical Standards in Government: The ban would establish a higher ethical standard, signaling a commitment to transparency and accountability in government operations. This could serve as a model for other levels of government.

Negative Effects or Challenges:

- Potential for Unintended Consequences: A complete ban might discourage qualified individuals from seeking public office, particularly those from financial backgrounds. Finding a balance between preventing conflicts of interest and maintaining a diverse pool of candidates would be crucial.

- Difficulties in Implementation: Enforcing a comprehensive ban would require robust oversight mechanisms and clear definitions of prohibited activities. This could pose significant logistical and legal challenges.

- Constitutional Concerns: Some might argue that a complete ban infringes on the rights of members of Congress, raising potential constitutional questions. Careful consideration of these issues would be necessary.

Comparison to Existing Legislation and Proposals

Currently, US law requires members of Congress to disclose their stock transactions, but it doesn't prohibit them entirely. This self-reporting system has been criticized for its lack of effectiveness.

Overview of Current Laws and Regulations

The Stop Trading on Congressional Knowledge (STOCK) Act of 2012 aimed to curb insider trading, but loopholes and weak enforcement remain concerns. Existing regulations are insufficient to address the underlying issue of perceived conflicts of interest.

Comparison to Other Proposed Solutions

Several bipartisan efforts propose stricter regulations, including blind trusts or limitations on the types of investments allowed. Trump's proposed outright ban differs significantly from these more moderate approaches. While these other proposals focus on mitigating the risk, Trump's approach aims for complete elimination.

Public Opinion and Political Response

Public opinion largely supports stronger ethics reform in Congress. Numerous polls indicate widespread dissatisfaction with the current system, with many believing a ban on stock trading is necessary.

Public Reaction to Trump's Proposal

The reaction to Trump’s proposal has been varied, reflecting the existing political divisions. While some applaud it as a necessary step towards greater transparency, others criticize it as an overreach.

Responses from Different Political Parties and Stakeholders

Democrats and Republicans have responded differently. While some Democrats might support aspects of the ban, others might question the feasibility or potential unintended consequences. Republicans, depending on their stance on government regulation, may have varied responses. Lobbying groups and financial institutions will likely weigh in with their own perspectives and potential concerns.

Conclusion: The Future of Trump's Proposed Ban on Congressional Stock Trading

Trump's proposed ban on congressional stock trading, as discussed in his Time Magazine interview, is a significant proposal aiming to address deep-seated concerns about ethics and transparency in government. While the potential benefits of improved public trust and reduced conflicts of interest are undeniable, potential drawbacks and implementation challenges need careful consideration. Its success depends on overcoming significant political hurdles and addressing constitutional concerns. The ongoing debate highlights the complex interplay between ethical governance, individual liberties, and the practicalities of legislative reform.

To stay informed about this evolving situation and to engage in the critical discussion surrounding Trump's proposed ban on congressional stock trading and similar ethics reform initiatives, explore resources from reputable news organizations and government watchdog groups. Your active participation in this conversation is vital for a more transparent and ethical government.

Featured Posts

-

Chat Gpt Maker Open Ai Targeted By Ftc An Analysis Of The Probe

Apr 26, 2025

Chat Gpt Maker Open Ai Targeted By Ftc An Analysis Of The Probe

Apr 26, 2025 -

Trumps Time Interview Key Takeaways On Proposed Ban Of Congressional Stock Trading

Apr 26, 2025

Trumps Time Interview Key Takeaways On Proposed Ban Of Congressional Stock Trading

Apr 26, 2025 -

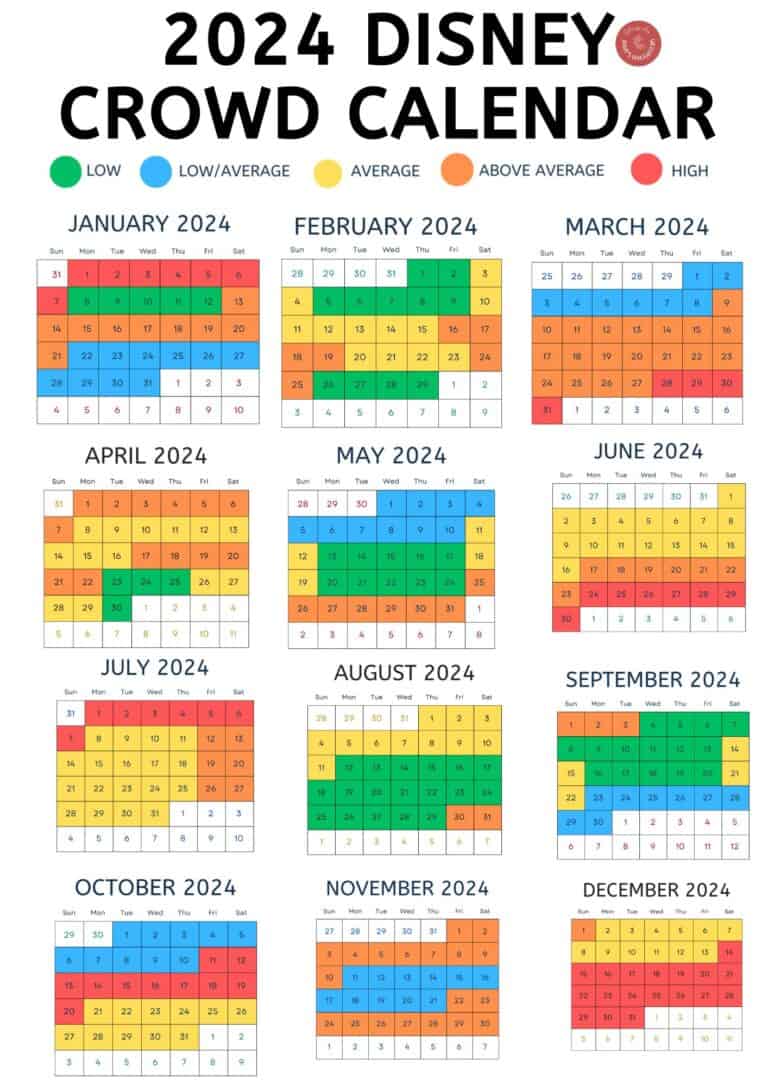

Escape Disney 7 Must Try Orlando Restaurants Opening In 2025

Apr 26, 2025

Escape Disney 7 Must Try Orlando Restaurants Opening In 2025

Apr 26, 2025 -

Cassidy Hutchinson Jan 6 Hearing Testimony To Become Memoir

Apr 26, 2025

Cassidy Hutchinson Jan 6 Hearing Testimony To Become Memoir

Apr 26, 2025 -

Economic Uncertainty Ceos Warn Of Trump Tariff Fallout

Apr 26, 2025

Economic Uncertainty Ceos Warn Of Trump Tariff Fallout

Apr 26, 2025