Understanding X's Transformation: Insights From Recent Debt Sale Financials

Table of Contents

Analyzing the Debt Sale: Key Figures and Implications

The specifics of X's debt sale are critical to understanding its impact. X successfully sold [Amount] in [Type of debt, e.g., high-yield bonds, term loans] to [Buyer(s), e.g., a consortium of institutional investors, a specific investment firm]. The timing of this sale, occurring on [Date], is also noteworthy, coinciding with [Relevant market conditions, e.g., a period of low interest rates, increased investor appetite for high-yield debt].

- Total debt sold: [Amount]

- Type of debt: [Specify type(s) of debt, e.g., senior unsecured notes, subordinated debt]

- Sale price and premium/discount: The debt was sold at [Price] per unit, representing a [Premium/Discount]% compared to the prevailing market price.

- Credit rating impact: Moody's and S&P have yet to release their updated ratings, but analysts predict a [Positive/Negative] change following this transaction.

- Buyer profile and implications: The sale to [Buyer(s)] suggests [Implications, e.g., confidence in X's future prospects, a strategic move by the buyer].

These figures suggest a significant improvement in X's financial health. The debt sale is likely to reduce X's debt-to-equity ratio, lower interest expense, and increase its financial flexibility, paving the way for future growth initiatives.

Strategic Rationale Behind the Debt Sale: A Shift in Corporate Strategy

X's stated rationale for the debt sale points towards a fundamental shift in its corporate strategy. The company's official statements cite [Reason 1, e.g., a need to reduce its overall debt burden and deleverage its balance sheet] and [Reason 2, e.g., the acquisition of a key competitor].

- Debt reduction and deleveraging: This was a primary driver, aiming to strengthen the balance sheet and improve financial stability.

- Funding for acquisitions or expansion: The proceeds from the sale are likely to be used for [Specific acquisition or expansion plans].

- Capital restructuring: The debt sale might be part of a broader capital restructuring strategy to optimize X's capital structure.

- Improved financial flexibility: Reducing debt frees up capital for future investments and operational flexibility.

- Responding to market conditions: The sale might have been strategically timed to take advantage of favorable market conditions.

This strategic shift signals a move towards [Long-term strategic goal, e.g., greater operational efficiency, aggressive expansion into new markets]. The long-term impact on X's operations and performance will depend on how effectively the company utilizes the proceeds from the sale.

Impact on X's Financial Performance: Short-Term and Long-Term Effects

The debt sale will have both immediate and long-term effects on X's key financial metrics.

- Impact on debt-to-equity ratio: The sale is expected to decrease X's debt-to-equity ratio from [Previous ratio] to [Projected ratio], significantly strengthening its financial position.

- Changes in interest expense: Reduced debt will lead to a considerable decrease in annual interest expense, boosting profitability.

- Impact on credit ratings: Although ratings agencies are yet to respond, a reduction in debt load typically leads to improved credit ratings, lowering the cost of future borrowing.

- Potential effects on profitability: Lower interest expense and improved operational efficiency could increase profitability in the short- and long-term.

- Long-term strategic advantages: Improved financial health should facilitate faster growth, increased competitiveness, and better opportunities for strategic acquisitions.

Analyzing X's balance sheet, income statement, and cash flow statement will reveal the precise quantitative impact of the debt sale on these financial metrics.

Investor Sentiment and Market Reaction: Analyzing Stock Price and Analyst Reports

The market reacted positively to the news of X's debt sale. X's stock price [Increased/Decreased] by [Percentage] following the announcement.

- Stock price movement before, during, and after the announcement: A detailed analysis of stock price fluctuations demonstrates investor confidence in the company's strategic direction.

- Analyst ratings and recommendations: Many analysts upgraded their rating and price target for X's stock, reflecting positive sentiment.

- Investor confidence levels: The positive market response indicates that investors generally view the debt sale favorably.

- Media coverage and public perception: Media coverage largely focused on the positive aspects of the sale, further bolstering investor confidence.

This positive investor sentiment signifies market approval of X's strategic repositioning. The improved financial health and increased financial flexibility should contribute to a higher valuation in the long run.

Conclusion: Understanding X's Transformation – A Look Ahead

X Corporation's recent debt sale represents a significant transformation in its financial strategy. By reducing its debt burden, X has improved its financial health, increased its financial flexibility, and signaled a commitment to long-term growth. The positive market reaction underscores investor confidence in this strategic shift. The long-term implications are positive, with the potential for increased profitability, faster growth, and a stronger competitive position. However, continued monitoring of X's performance and financial statements is crucial to fully understand the lasting impact of this transformation. To gain a more comprehensive understanding of Understanding X's Transformation, continue monitoring X's progress, delve deeper into its financial statements, subscribe to relevant financial news sources, and consider seeking professional financial advice.

Featured Posts

-

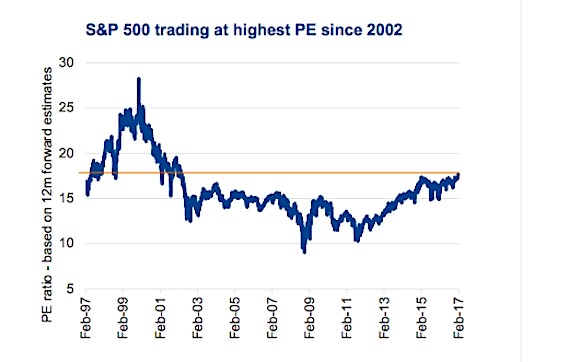

High Stock Valuations Bof As Argument For Investor Calm

Apr 28, 2025

High Stock Valuations Bof As Argument For Investor Calm

Apr 28, 2025 -

Asatyr Almwsyqa Alealmyt Ttalq Fy Mhrjan Abwzby Alsabe Waleshryn

Apr 28, 2025

Asatyr Almwsyqa Alealmyt Ttalq Fy Mhrjan Abwzby Alsabe Waleshryn

Apr 28, 2025 -

Slight Lineup Change For Red Sox Doubleheader Game 1

Apr 28, 2025

Slight Lineup Change For Red Sox Doubleheader Game 1

Apr 28, 2025 -

Open Ai Simplifies Voice Assistant Development 2024 Event Highlights

Apr 28, 2025

Open Ai Simplifies Voice Assistant Development 2024 Event Highlights

Apr 28, 2025 -

Explore Abu Dhabi 10 Gb Uae Sim And 15 Attraction Discount

Apr 28, 2025

Explore Abu Dhabi 10 Gb Uae Sim And 15 Attraction Discount

Apr 28, 2025