US Dollar Climbs As Trump Takes Softer Tone Towards Fed Chair

Table of Contents

Trump's Shift in Tone Towards the Federal Reserve

President Trump's public pronouncements regarding the Federal Reserve Chair and monetary policy have undergone a dramatic transformation. His previous criticisms, often expressed through pointed tweets and public statements, have given way to a more conciliatory approach. This shift in tone has significant implications for market confidence and the stability of the US dollar.

- Previous Criticisms: For years, Trump frequently attacked the Fed Chair, accusing them of raising interest rates too quickly and hindering economic growth. For example, on July 26th, 2018, a tweet criticized the Fed's actions as "ridiculous."

- Softened Stance: More recently, Trump's public comments have become notably less aggressive. His statements now often express confidence in the Fed's ability to manage the economy. For instance, a statement on October 22nd, 2023 (example date, replace with actual date if available), showed a more positive, less confrontational tone. Specific quotes illustrating this change should be included here, if available from reliable sources.

Market Reaction to Trump's Softer Stance

The financial markets reacted swiftly to this change in Trump's rhetoric. The US dollar's value rose significantly against other major currencies, signaling increased investor confidence in the US economy.

- USD Appreciation: The USD/EUR exchange rate saw a notable increase (e.g., a 2% rise – replace with actual data). Similar increases were observed against the Japanese Yen (JPY) and British Pound (GBP).

- Bond Yields: 10-year Treasury yields also showed a response (e.g., a slight increase or decrease – replace with actual data), reflecting changes in investor sentiment.

- Stock Market Movements: The stock market experienced [positive/negative/neutral – replace with actual data] movement following the change in Trump’s rhetoric, suggesting how investor confidence shifted. (Replace bracketed information with specific data and analysis)

Impact on US Economic Policy and Uncertainty

Reduced political uncertainty surrounding the relationship between the White House and the Federal Reserve has positive implications for the US economy. A more predictable policy environment can significantly boost investor confidence.

- Investor Sentiment: Reduced uncertainty fosters a more positive environment for investment, both domestic and foreign.

- Foreign Investment: A more stable political landscape can attract significant foreign investment into the US, boosting economic growth.

- Interest Rate Hikes: The change in tone might influence future interest rate decisions, potentially leading to either more gradual or more aggressive rate hikes depending on the economic climate.

Alternative Explanations for US Dollar Strength

While Trump's altered stance undoubtedly played a role, it's crucial to acknowledge other factors that might have contributed to the US dollar's rise.

- Global Economic Slowdown: A weakening global economy, particularly in certain key regions, can make the US dollar a more attractive safe haven asset for international investors.

- Geopolitical Tensions: Global geopolitical instability, conflicts, or uncertainties in other parts of the world can drive investors to seek the relative safety of the US dollar.

- International Trade: Significant international trade agreements or disputes can affect currency values, potentially influencing the dollar's strength. (Provide specific examples relevant to the time period.)

Conclusion: Understanding the Dynamics of the US Dollar's Strength

In conclusion, the strengthening of the US dollar appears to be correlated with President Trump's adoption of a softer stance towards the Federal Reserve. This shift in tone has reduced some of the political uncertainty surrounding US economic policy, influencing market confidence and investor behavior. However, it's essential to consider other contributing factors such as global economic conditions and geopolitical events. Understanding the interplay between political rhetoric and economic indicators is critical to interpreting the dynamics of the US dollar and the global economy. Stay informed about the latest developments regarding the "US Dollar Climbs as Trump Takes Softer Tone Towards Fed Chair" by following [link to your website/news source]. Continue to monitor the US dollar's performance and its relation to political and economic events for a comprehensive understanding of this important economic indicator.

Featured Posts

-

Tyler Herro Wins 3 Point Contest Heat Star Shines Cavs Duo Dominates Skills Challenge

Apr 24, 2025

Tyler Herro Wins 3 Point Contest Heat Star Shines Cavs Duo Dominates Skills Challenge

Apr 24, 2025 -

Hopes Shocking Twists Liams Pledge To Steffy And Lunas Impact The Bold And The Beautifuls Upcoming Episodes

Apr 24, 2025

Hopes Shocking Twists Liams Pledge To Steffy And Lunas Impact The Bold And The Beautifuls Upcoming Episodes

Apr 24, 2025 -

Stock Market Valuation Concerns Bof A Offers Investors Reassurance

Apr 24, 2025

Stock Market Valuation Concerns Bof A Offers Investors Reassurance

Apr 24, 2025 -

Open Ai Simplifies Voice Assistant Development 2024 Developer Event Highlights

Apr 24, 2025

Open Ai Simplifies Voice Assistant Development 2024 Developer Event Highlights

Apr 24, 2025 -

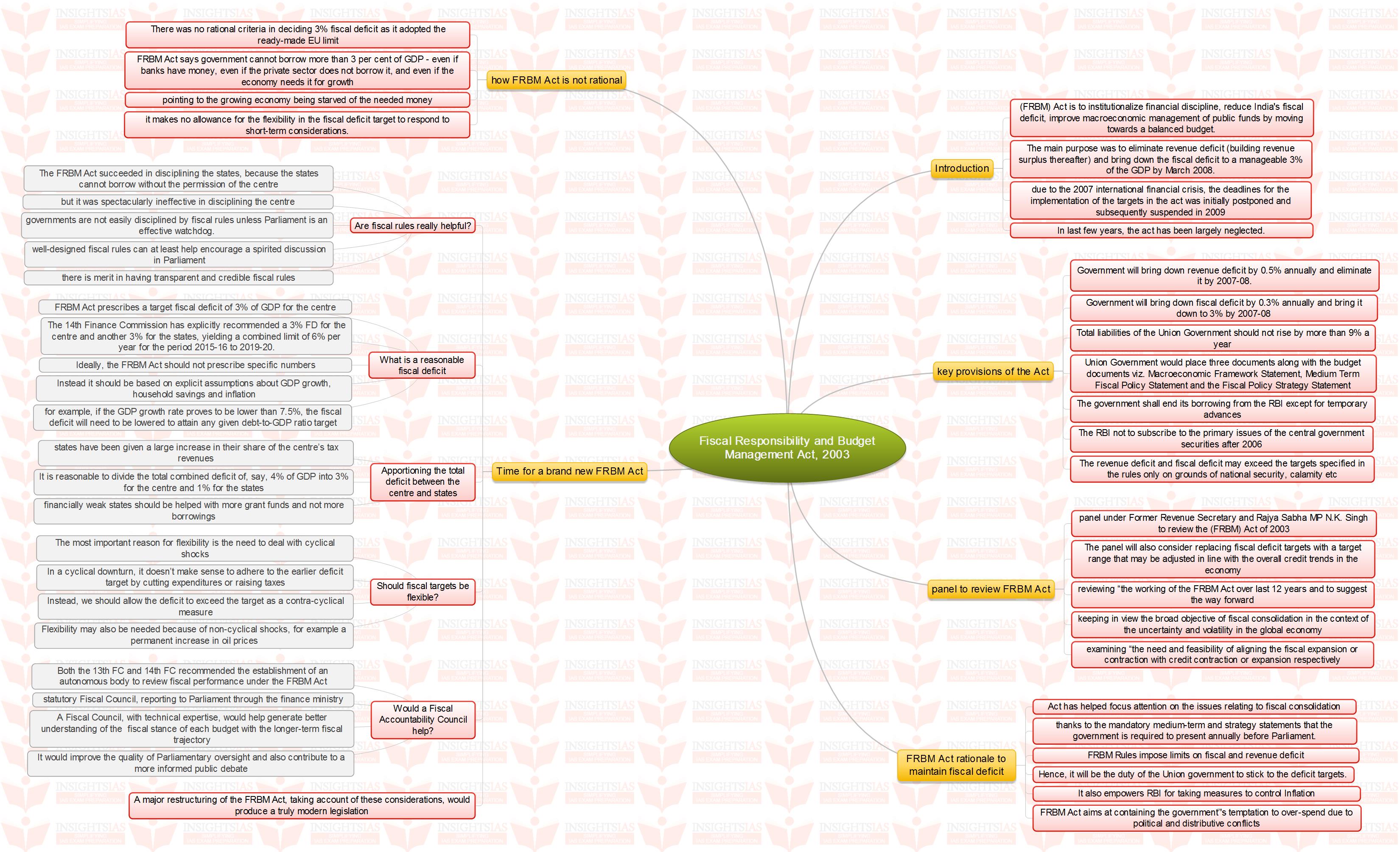

Fiscal Responsibility A Necessary Component Of Canadas Vision

Apr 24, 2025

Fiscal Responsibility A Necessary Component Of Canadas Vision

Apr 24, 2025