US Dollar Gains Ground Amid Reduced Tensions With The Fed

Table of Contents

Easing Concerns Regarding Federal Reserve Policy

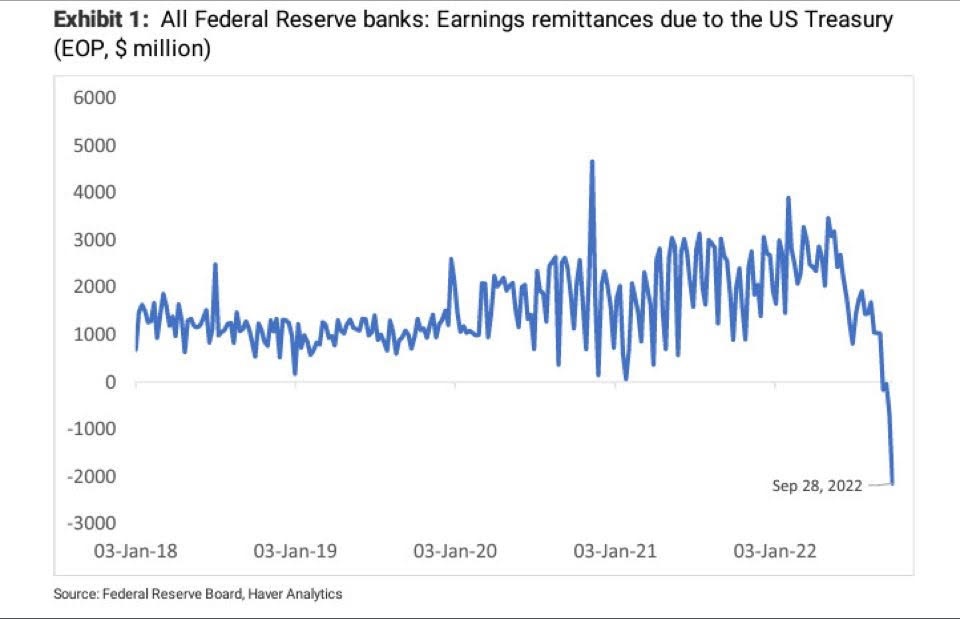

Uncertainty about the Federal Reserve's future interest rate hikes had previously weakened the dollar. Aggressive rate hikes were anticipated to combat inflation, but concerns about their potential negative impact on economic growth fueled market volatility and dampened investor confidence in the US dollar. However, recent data and announcements have calmed these fears.

- Lower-than-expected inflation figures: Several key inflation indicators have shown a slowdown, suggesting the Fed's tightening monetary policy is starting to have the desired effect. This positive data has reduced concerns about runaway inflation and the need for excessively aggressive interest rate increases.

- Signals from the Fed suggesting a potential pause in rate hikes: Recent statements from Fed officials have hinted at a potential slowdown or even a pause in future rate hikes, signaling a more measured approach to monetary policy. This shift in communication has significantly improved market confidence.

- Improved market confidence in the Fed's ability to manage inflation: The combination of slowing inflation and more measured communication from the Fed has boosted market confidence in its ability to manage inflation without triggering a significant economic downturn. This increased confidence has directly contributed to the increased demand for the US dollar.

This reduced uncertainty has led to a significant shift in investor behavior, with capital flowing back into US dollar-denominated assets, thereby driving up its value. The reduced risk associated with holding US dollars is a key driver of this renewed strength.

Global Economic Headwinds Supporting the Dollar's Safe-Haven Status

Global economic instability, including escalating geopolitical tensions and persistent recessionary fears in various regions, is bolstering the US dollar's safe-haven status. Investors, seeking refuge from global uncertainty, are flocking to the perceived safety and stability of the US dollar and US Treasury bonds.

- Geopolitical risks impacting other major currencies: Ongoing geopolitical conflicts and economic instability in several regions are creating uncertainty and weakening other major currencies, making the US dollar a more attractive option for investors seeking stability.

- Concerns about economic growth in other regions: Slowing economic growth in Europe and Asia, coupled with ongoing energy crises and supply chain disruptions, is further contributing to the flight to safety towards the US dollar.

- Increased demand for US Treasuries as a safe investment: US Treasury bonds are considered a safe-haven asset, and the increased demand for these bonds is further supporting the US dollar's strength.

The strong correlation between global economic uncertainty and US dollar strength is evident, with the dollar consistently appreciating during periods of heightened global risk aversion. This safe-haven appeal is a significant factor in the current strengthening of the US dollar.

Strength of the US Economy Relative to Other Major Economies

The relative strength of the US economy compared to its major counterparts is another key factor driving US dollar appreciation. While global economic headwinds persist, the US economy continues to demonstrate resilience in key areas.

- Robust US job growth: The US labor market remains robust, with consistent job creation and low unemployment rates, indicating a healthy economy.

- Resilient consumer spending despite inflation: Despite persistent inflation, US consumer spending has remained relatively resilient, demonstrating underlying economic strength.

- Comparative analysis of GDP growth across major economies: Compared to several major economies facing slower growth or even recession, the US economy's relatively stronger performance is making the US dollar more attractive.

This comparative economic strength is influencing currency exchange rates, making the US dollar a more desirable currency for international trade and investment. The perception of relative stability and continued growth further enhances the US dollar's appeal.

Potential Risks and Future Outlook for the US Dollar

While the current trend is positive, several potential risks could reverse the US dollar's gains.

- Potential for renewed inflation concerns: A resurgence in inflation could force the Fed to resume more aggressive interest rate hikes, potentially dampening economic growth and weakening the dollar.

- Impact of unexpected geopolitical developments: Unexpected geopolitical events could trigger a renewed flight to safety, but not necessarily towards the US dollar, depending on the nature and impact of the event.

- Predictions from financial analysts regarding future dollar movement: Financial analysts offer varying predictions, with some suggesting continued strength while others foresee a potential correction.

The future outlook for the US dollar remains somewhat uncertain, depending on the evolution of these factors. A cautiously optimistic outlook prevails, but constant monitoring of economic indicators and geopolitical developments is crucial.

Conclusion: Understanding the US Dollar's Recent Strength

The recent strengthening of the US dollar is a complex phenomenon driven by a confluence of factors. Easing concerns about Federal Reserve policy, the dollar's safe-haven appeal amid global economic uncertainty, and the relative strength of the US economy all contribute to the current trend. Monitoring these factors closely is crucial for predicting future movements. To stay informed about the latest developments impacting the US dollar and for further analysis and updates on "US dollar gains ground amid reduced tensions with the Fed," subscribe to our newsletter or follow us on social media! Understanding the nuances of US dollar strength is key for navigating today's volatile markets.

Featured Posts

-

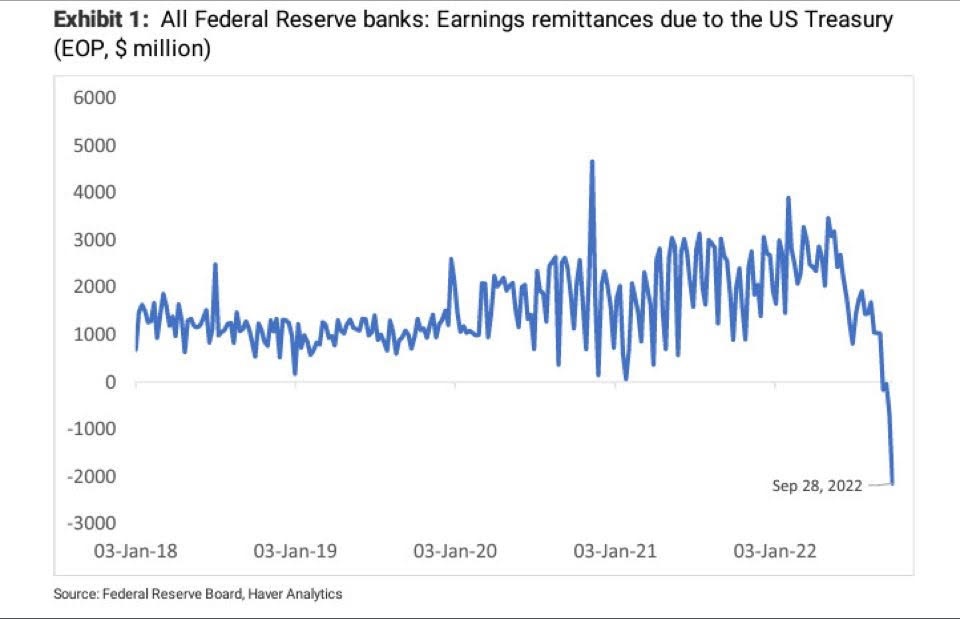

5 Essential Dos And Don Ts Succeeding In The Private Credit Market

Apr 24, 2025

5 Essential Dos And Don Ts Succeeding In The Private Credit Market

Apr 24, 2025 -

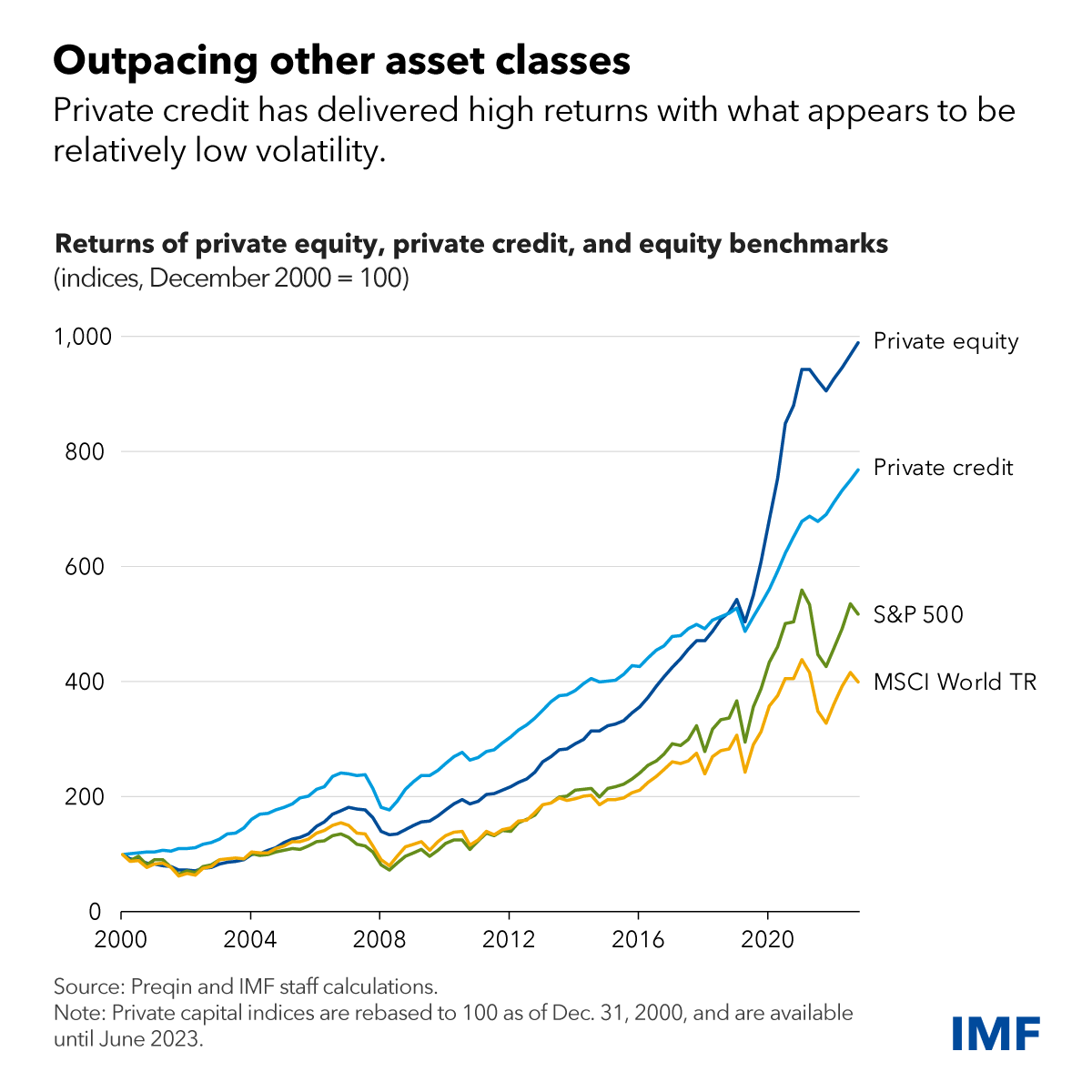

Office365 Data Breach Leads To Millions In Losses Criminal Charges Filed

Apr 24, 2025

Office365 Data Breach Leads To Millions In Losses Criminal Charges Filed

Apr 24, 2025 -

Soft Bank And Tether Partner With Cantor In Potential 3 Billion Crypto Spac

Apr 24, 2025

Soft Bank And Tether Partner With Cantor In Potential 3 Billion Crypto Spac

Apr 24, 2025 -

Minnesota Ag Preemptively Challenges Trumps Transgender Sports Ban

Apr 24, 2025

Minnesota Ag Preemptively Challenges Trumps Transgender Sports Ban

Apr 24, 2025 -

Village Roadshows 417 5 Million Alcon Deal Approved Key Details

Apr 24, 2025

Village Roadshows 417 5 Million Alcon Deal Approved Key Details

Apr 24, 2025