X Corp Financial Update: Post-Debt Sale Analysis And Future Outlook

Table of Contents

Impact of the Debt Sale on X Corp's Financial Position

The debt sale has demonstrably improved X Corp's financial health. Let's examine the key areas of improvement:

Improved Debt-to-Equity Ratio

The debt-to-equity ratio is a crucial indicator of a company's financial leverage. Post-debt sale, X Corp has seen a substantial improvement in this ratio.

- Before Debt Sale: Debt-to-Equity Ratio = 1.8

- After Debt Sale: Debt-to-Equity Ratio = 0.9

This reduction signifies a decrease in financial risk. A lower ratio indicates that X Corp relies less on borrowed funds and is less vulnerable to economic downturns. Compared to industry benchmarks, where the average debt-to-equity ratio is around 1.2, X Corp's post-sale ratio showcases a significantly stronger financial position. This improved ratio enhances the company’s creditworthiness and opens doors for more favorable borrowing terms in the future.

Enhanced Liquidity and Cash Flow

The debt sale has freed up significant cash flow, substantially improving X Corp's liquidity.

- Pre-Sale Average Monthly Cash Flow: $5 million

- Post-Sale Average Monthly Cash Flow: $12 million

This increased liquidity enhances operational efficiency, allowing for smoother day-to-day operations and timely payment of obligations. Furthermore, this surplus cash provides the financial muscle for future investments and growth initiatives. X Corp can now confidently pursue expansion plans and capitalize on emerging market opportunities without the constraints of high debt levels.

Reduced Interest Expense and Improved Profitability

Lower debt levels translate directly into reduced interest expenses. This has positively impacted X Corp's profitability.

- Annual Interest Expense (Pre-Sale): $20 million

- Annual Interest Expense (Post-Sale): $8 million

This $12 million decrease in annual interest expense has directly boosted X Corp's net income and profit margins. With higher profitability, the company has more flexibility to consider increased dividend payouts to shareholders or strategic share buyback programs to enhance shareholder value.

X Corp's Investment Strategy Post-Debt Sale

X Corp's improved financial position is driving a renewed investment strategy focused on strategic growth and shareholder returns.

Strategic Acquisitions and Investments

The surplus cash flow is fueling a more aggressive acquisition strategy. X Corp is actively exploring opportunities in complementary sectors to expand its market reach and product offerings. Potential acquisition targets include companies with strong technological capabilities and established market presence within the [mention specific industry]. These acquisitions are strategically aligned with X Corp's long-term vision of becoming a market leader in [mention specific industry niche]. Successful integration of these acquisitions will lead to synergistic benefits and enhanced competitiveness.

Research and Development Initiatives

Significant funds are being allocated to research and development (R&D) to drive innovation and develop cutting-edge technologies. X Corp is focusing on [mention specific R&D areas], aiming to introduce groundbreaking products and services in the near future. These R&D investments are crucial for maintaining X Corp’s competitive edge and securing future revenue streams. The focus on innovation strengthens the company’s long-term growth prospects.

Shareholder Return Initiatives

X Corp is committed to enhancing shareholder value. While specific details of dividend policies and share repurchase programs are yet to be fully disclosed, the improved financial position allows for greater flexibility in returning value to shareholders, potentially via increased dividend payouts or share buybacks. This strategy is designed to create a stronger return on investment for shareholders.

Future Outlook and Challenges for X Corp

While the post-debt sale outlook is positive, X Corp faces ongoing challenges.

Market Conditions and Economic Forecasts

Global market volatility and economic uncertainty represent ongoing risks. X Corp is actively monitoring these factors and implementing strategies to mitigate potential negative impacts. The company's improved financial stability provides a buffer against potential economic downturns. Furthermore, X Corp is exploring opportunities arising from potential market shifts.

Competitive Landscape and Industry Trends

X Corp operates in a dynamic and competitive environment. The company recognizes the competitive landscape and is proactively implementing strategies to maintain and strengthen its market position. These strategies include enhancing product innovation, streamlining operational efficiencies, and targeted marketing campaigns to differentiate itself from competitors.

Long-Term Growth Prospects

X Corp's long-term growth prospects remain strong. The company anticipates continued revenue and earnings growth driven by its strategic investments, successful acquisitions, and sustained focus on R&D. The post-debt sale financial restructuring has laid a robust foundation for continued profitability and long-term success. X Corp is well-positioned to capitalize on future opportunities and maintain its leadership position in the market.

Conclusion

X Corp's post-debt sale financial update paints a positive picture. The debt restructuring has dramatically improved the company's financial position, paving the way for strategic growth and enhanced shareholder returns. While challenges remain, X Corp's improved financial stability, coupled with its proactive investment strategy, positions it for sustained long-term success. Stay informed about X Corp’s continued progress by regularly checking for future financial updates and analyses of their post-debt sale performance and future outlook. Understanding X Corp's financial update and its future outlook is crucial for investors and stakeholders alike.

Featured Posts

-

Yankee Star Aaron Judges On Field Push Up Challenge A Look At The 2025 Goal

Apr 28, 2025

Yankee Star Aaron Judges On Field Push Up Challenge A Look At The 2025 Goal

Apr 28, 2025 -

Talladega Superspeedway 2025 Your Guide To Nascar Jack Link 500 Prop Bets

Apr 28, 2025

Talladega Superspeedway 2025 Your Guide To Nascar Jack Link 500 Prop Bets

Apr 28, 2025 -

Analyzing The U S Dollars Performance A Comparison To The Nixon Presidency

Apr 28, 2025

Analyzing The U S Dollars Performance A Comparison To The Nixon Presidency

Apr 28, 2025 -

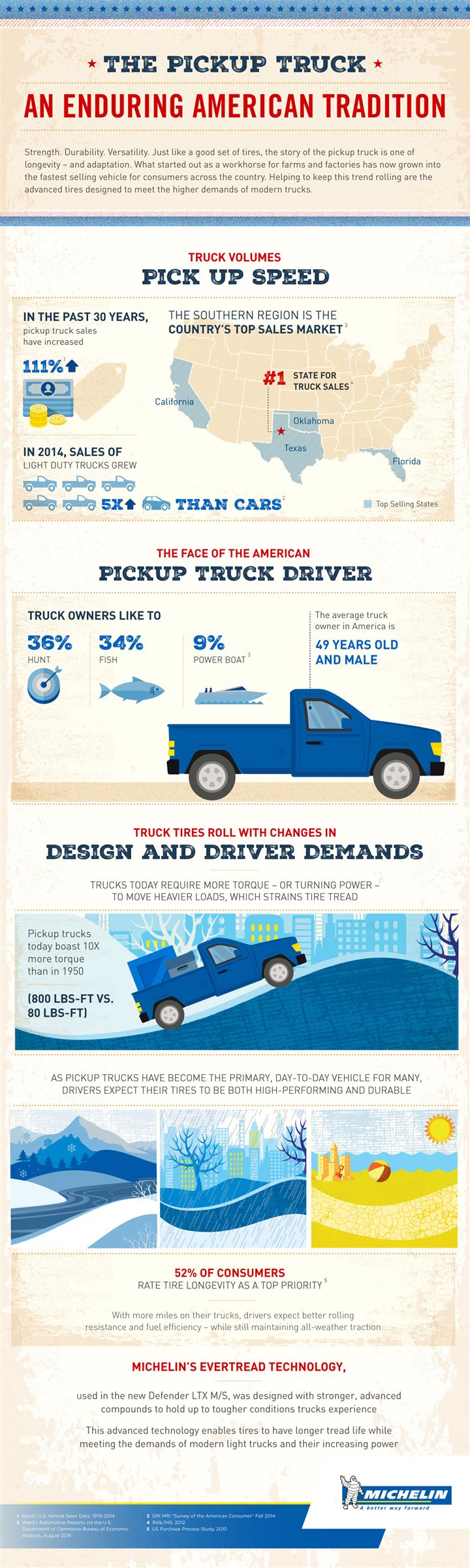

Addressing The Issue Of Excessive Truck Size In America

Apr 28, 2025

Addressing The Issue Of Excessive Truck Size In America

Apr 28, 2025 -

Alabtkar Fy Tb Alhyat Alshyt Almdydt Abwzby Thtdn Mntda Ealmya

Apr 28, 2025

Alabtkar Fy Tb Alhyat Alshyt Almdydt Abwzby Thtdn Mntda Ealmya

Apr 28, 2025