Ackman's Trade War Prediction: US Vs. China

Table of Contents

H2: Ackman's Stance on the US-China Trade War

Bill Ackman has consistently voiced strong concerns regarding the escalating US-China trade war. He views the ongoing tensions not merely as a trade dispute, but as a significant geopolitical risk with far-reaching economic consequences.

- Specific Statements: While Ackman hasn't issued a single, comprehensive statement explicitly titled "Ackman's Trade War Prediction," his concerns have been expressed through various interviews and presentations. He frequently emphasizes the interconnected nature of the US and Chinese economies and the potential for severe disruption.

- Key Risks Identified: Ackman highlights several key risks stemming from the trade war, including:

- Significant supply chain disruptions, leading to shortages and higher prices.

- Increased inflation, potentially triggering a recessionary environment.

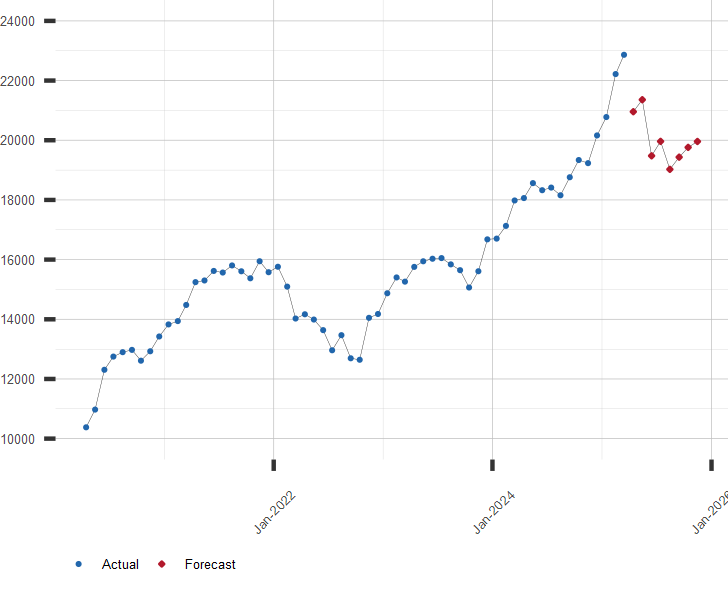

- Heightened market volatility, impacting investor confidence and portfolio performance.

- Vulnerable Sectors: Ackman's analysis points towards several sectors particularly vulnerable to the trade war's impact, including technology, manufacturing, and consumer goods reliant on either US or Chinese production. The specific companies he identifies as vulnerable often change based on market conditions and his firm's portfolio.

H2: Analyzing the Underlying Factors of Ackman's Prediction

Ackman's perspective isn't based solely on tariffs; it encompasses a broader analysis of US-China relations.

- Geopolitical Tensions: The trade war is only one facet of the complex and increasingly strained relationship between the US and China. Tensions extend to technology (e.g., semiconductor dominance), human rights, and geopolitical influence. This broader context fuels Ackman's concerns.

- Global Supply Chain Decoupling: The ongoing effort to decouple the US and Chinese economies is a central theme in Ackman’s analysis. This decoupling, while potentially reducing reliance on a single nation, also leads to significant disruptions and increased costs.

- Inflationary Pressures and Recessionary Risks: The trade war exacerbates existing inflationary pressures, potentially leading to higher interest rates and a slowing global economy. This is a key element influencing Ackman’s pessimistic outlook.

- Industry-Specific Impacts: Industries heavily reliant on imports or exports between the US and China are particularly vulnerable. Technology, due to its intricate global supply chains and reliance on specialized components from both countries, is often cited as an example.

H2: Investment Implications of Ackman's Trade War Prediction

Ackman's prediction necessitates a reassessment of investment strategies. Navigating this complex landscape requires both defensive and offensive approaches.

- Risk Mitigation Strategies: Investors should consider strategies to mitigate the risks associated with the trade war:

- Diversification: Expanding investment portfolios across different asset classes and geographical regions to reduce exposure to any single market.

- Hedging: Employing financial instruments to protect against potential losses from market fluctuations.

- Identifying Opportunities: While the trade war presents significant risks, it also creates opportunities:

- Reshoring: Companies might choose to relocate manufacturing back to the US or other regions, creating investment opportunities in domestic production.

- Alternative Investments: Exploring alternative asset classes, such as commodities or infrastructure, that might be less affected by the trade war.

- Sector Allocation: Based on Ackman's insights, investors might consider overweighting sectors less sensitive to the trade war while underweighting those most directly exposed to US-China tensions.

H2: Alternative Perspectives and Criticisms of Ackman's Prediction

While Ackman's warnings carry significant weight, it's essential to consider alternative viewpoints.

- Contrasting Opinions: Some economists and analysts argue that the impact of the trade war might be less severe than Ackman predicts. They highlight the resilience of global supply chains and the potential for negotiation and compromise between the US and China.

- Limitations of Ackman's Analysis: Critics point out that Ackman's focus on the negative aspects of the trade war might overshadow potential positive developments or underestimate the adaptability of businesses and governments.

- De-escalation Potential: The possibility of de-escalation or a negotiated settlement between the US and China remains. A more conciliatory approach could significantly alter the economic landscape.

3. Conclusion:

Bill Ackman's concerns regarding the US-China trade war are rooted in a deep understanding of the interconnected global economy and the complex geopolitical dynamics at play. His prediction highlights the significant risks of supply chain disruptions, inflation, and market volatility. However, a balanced perspective acknowledges alternative viewpoints and the potential for de-escalation. The key takeaway is the need for careful risk management and a well-diversified investment strategy. To navigate this complex environment, stay informed about Ackman's insights on the US-China trade war and understand the implications of his trade war prediction for your own portfolio. Develop an informed investment strategy based on Ackman’s US-China trade war analysis and your own risk tolerance. Conduct thorough research and consider seeking professional financial advice before making any significant investment decisions.

Featured Posts

-

Dows Canadian Project Construction Delayed By Market Volatility

Apr 27, 2025

Dows Canadian Project Construction Delayed By Market Volatility

Apr 27, 2025 -

Analysis Of Vaccine Studies Hhss Choice Of David Geier Raises Concerns

Apr 27, 2025

Analysis Of Vaccine Studies Hhss Choice Of David Geier Raises Concerns

Apr 27, 2025 -

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025

Charleston Open Pegula Upsets Defending Champion Collins

Apr 27, 2025 -

The China Factor Challenges For Luxury Automakers Like Bmw And Porsche

Apr 27, 2025

The China Factor Challenges For Luxury Automakers Like Bmw And Porsche

Apr 27, 2025 -

German Dax Index Analyzing The Influence Of Politics And Economics

Apr 27, 2025

German Dax Index Analyzing The Influence Of Politics And Economics

Apr 27, 2025