Analyzing The Effectiveness Of Minnesota's Film Tax Credit Program

Table of Contents

Economic Impact of the Minnesota Film Tax Credit

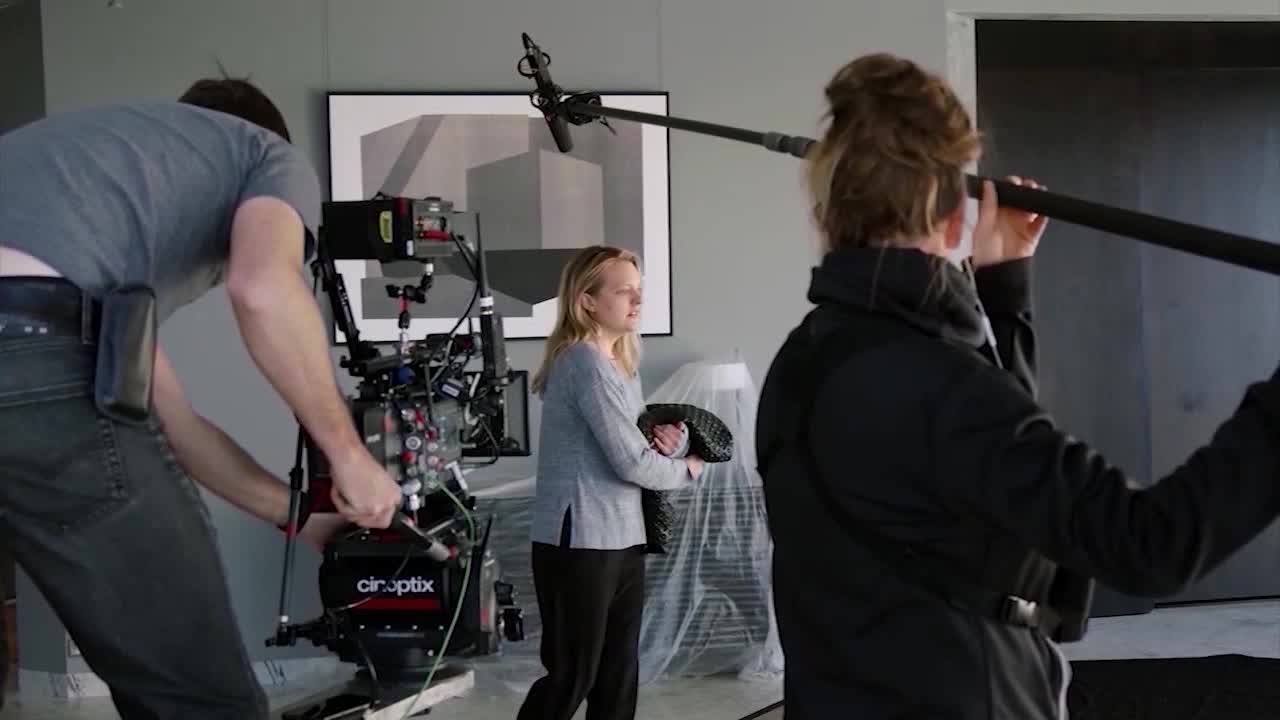

The Minnesota film tax credit plays a significant role in boosting the state's economy. Film productions, incentivized by the credit, inject substantial capital into local communities. This economic contribution extends beyond direct spending by production companies.

- Direct Spending: This includes salaries for actors, crew members, and other production personnel; equipment rentals; and other on-set expenses. These funds directly contribute to the incomes of Minnesota residents.

- Indirect Spending: The ripple effect is substantial. Film crews utilize local hotels, restaurants, transportation services, and other businesses, generating significant indirect spending that benefits a wide range of industries.

- Multiplier Effect: Economic modeling studies can quantify the multiplier effect of film production spending. Each dollar spent directly on a production generates additional spending in related industries, amplifying the overall economic impact of the film tax credit.

- Comparison with Neighboring States: Analyzing Minnesota's film incentive program alongside those in neighboring states like Wisconsin, Iowa, and North Dakota provides valuable context and allows for a comparative assessment of its effectiveness. Are the incentives competitive enough to attract productions away from neighboring states with similar programs?

- Analysis of Economic Modeling Studies: Rigorous economic modeling studies are crucial for accurately assessing the economic impact of the film tax credit. These studies should consider both direct and indirect effects, as well as the multiplier effect, to provide a comprehensive picture.

Job Creation and Workforce Development through Minnesota Film Incentives

The Minnesota film tax credit significantly contributes to job creation, both directly and indirectly. The industry fosters employment opportunities across diverse skill sets.

- Number of Jobs Created Annually: Tracking the number of jobs created annually by film productions utilizing the tax credit provides a concrete measure of the program's success.

- Breakdown of Job Types: Analyzing the types of jobs created, ranging from actors and directors to crew members, support staff, and skilled labor, reveals the program's impact on different segments of the workforce.

- Impact on Local Workforce Training Initiatives: The film industry presents opportunities for workforce development. The tax credit's role in supporting or incentivizing local training programs that equip individuals with film-related skills should be examined.

- Analysis of Long-Term Job Sustainability: Does the film tax credit lead to the creation of sustainable, long-term jobs in the Minnesota film industry, or are the jobs primarily temporary and project-based?

- Study of the Skills Gap: The tax credit could potentially address skills gaps within the Minnesota workforce by incentivizing the development of necessary skills and attracting skilled workers from other regions.

Growth of Minnesota's Film Production Industry

The impact of the Minnesota film tax credit on the growth of the state's film production industry is a key area of analysis.

- Number of Film Productions Per Year: Tracking the number of film productions utilizing the tax credit over time provides a clear indication of the program's influence on attracting productions to Minnesota.

- Types of Productions Attracted: The program's success is also measured by the types of productions it attracts – feature films, television series, commercials, documentaries, etc. A diverse range of productions suggests a broader and more sustainable impact.

- Geographic Distribution of Filming Locations: Analyzing the geographic distribution of filming locations helps determine whether the tax credit is benefiting various regions within Minnesota or is concentrated in specific areas.

- Analysis of Productions Choosing Minnesota: A crucial element involves understanding why productions choose Minnesota over other locations offering similar incentives. Is it the landscape, the crew base, or other factors?

- Long-Term Growth Trend Analysis: A long-term perspective is essential to assess the sustained impact of the Minnesota film tax credit on the overall growth trajectory of the film industry in the state.

Challenges and Limitations of the Minnesota Film Tax Credit Program

While the Minnesota film tax credit offers numerous benefits, it also faces challenges and limitations.

- Budgetary Constraints: The program's effectiveness is inherently linked to its budget. Insufficient funding may limit its reach and impact.

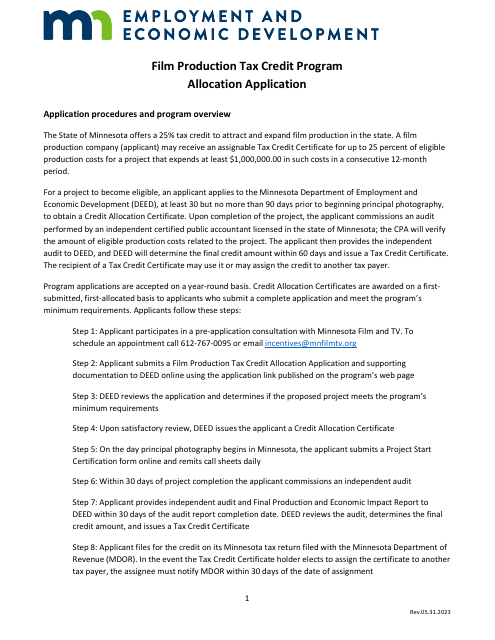

- Program Eligibility Criteria: The specific criteria for eligibility can influence which productions benefit from the tax credit and may unintentionally exclude certain projects.

- Administrative Burden: The application process and administrative requirements associated with the tax credit may impose burdens on production companies, potentially discouraging participation.

- Potential for Fraud or Abuse: Any incentive program runs the risk of fraud or abuse, which needs to be carefully monitored and addressed.

- Suggestions for Program Reform: Identifying areas for program improvement, such as streamlining the application process or adjusting eligibility criteria, can enhance its effectiveness and efficiency.

Comparative Analysis with Other States' Film Incentive Programs

Comparing Minnesota's film tax credit program with similar programs in other states offers valuable insights.

- Comparison with States like California, Georgia, New York: A benchmark analysis against states with established film industries and robust incentive programs allows for a relative assessment of Minnesota's competitiveness.

- Analysis of Different Incentive Structures: Different states utilize various incentive structures, such as tax credits, rebates, or a combination of both. Analyzing their effectiveness provides valuable context for Minnesota's program.

- Study of the Impact of Different Program Parameters: Factors such as credit amount, eligibility requirements, and application processes significantly influence program effectiveness. Analyzing variations among states can reveal best practices.

- Identification of Successful Strategies: Learning from successful strategies implemented in other states can help inform improvements to Minnesota's film tax credit program.

Conclusion: Assessing the Effectiveness of Minnesota's Film Tax Credit Program

This analysis demonstrates that Minnesota's film tax credit program has a notable impact on the state's economy, generating jobs and fostering the growth of the film industry. However, challenges related to budget constraints, administrative burdens, and the potential for abuse need to be addressed. Comparing the program to those in other states reveals both strengths and areas for improvement. To maximize its effectiveness, the program could benefit from ongoing evaluation, adjustments to eligibility criteria, and streamlined administration. We urge you to contact your state representatives to share your views on the Minnesota film tax credit and participate in the ongoing discussion shaping the future of film incentives in Minnesota. Let's work together to ensure that this vital program continues to thrive and support the growth of our state's dynamic film industry.

Featured Posts

-

Analyzing The Effectiveness Of Minnesotas Film Tax Credit Program

Apr 29, 2025

Analyzing The Effectiveness Of Minnesotas Film Tax Credit Program

Apr 29, 2025 -

Texas Woman Killed In Wrong Way Crash Near Minnesota North Dakota Border

Apr 29, 2025

Texas Woman Killed In Wrong Way Crash Near Minnesota North Dakota Border

Apr 29, 2025 -

First Look Adidas Anthony Edwards 2 Basketball Shoes

Apr 29, 2025

First Look Adidas Anthony Edwards 2 Basketball Shoes

Apr 29, 2025 -

Will Minnesota Film Tax Credits Attract More Productions

Apr 29, 2025

Will Minnesota Film Tax Credits Attract More Productions

Apr 29, 2025 -

Minnesota Defiance Of Trumps Transgender Athlete Ban Federal Action Threatened

Apr 29, 2025

Minnesota Defiance Of Trumps Transgender Athlete Ban Federal Action Threatened

Apr 29, 2025