Crack The Code: 5 Do's And Don'ts For A Private Credit Job

Table of Contents

5 DO's for a Successful Private Credit Job Search

Do Your Research: Understand the Private Credit Landscape

Before diving into your job search, thoroughly research the private credit market. This demonstrates your commitment and understanding to potential employers.

- Explore Different Strategies: Familiarize yourself with various private credit strategies, including direct lending, fund-of-funds, special situations, and distressed debt. Understanding the nuances of each approach is crucial.

- Master Credit Structures: Grasp the intricacies of different credit structures such as senior debt, subordinated debt, mezzanine debt, and unitranche debt. Knowing the risks and rewards associated with each is vital for effective credit analysis.

- Identify Key Players: Research prominent private credit firms, their investment strategies, and recent market activity. This knowledge will help you tailor your applications and demonstrate your awareness of the industry landscape. Knowing the difference between a Private Debt Fund and a direct lender is important.

- Stay Updated on Trends: Follow industry news and publications to stay abreast of current market trends, regulatory changes, and emerging investment opportunities in private credit. Understanding these trends shows your proactive engagement with the sector.

- Keywords: Direct Lending, Mezzanine Debt, Senior Debt, Subordinated Debt, Private Debt Funds, Private Credit Strategies, Distressed Debt, Unitranche Debt, Private Credit Analyst Jobs

Highlight Relevant Skills and Experience

Your resume and cover letter should showcase your capabilities in a compelling way. Quantify your accomplishments whenever possible to demonstrate impact.

- Analytical Prowess: Emphasize your proficiency in financial modeling, valuation techniques (DCF, LBO modeling), credit analysis, and financial statement analysis.

- Underwriting Expertise: Highlight your experience in underwriting loans, conducting due diligence, and assessing credit risk. Be specific about your role in the process.

- Portfolio Management Skills (if applicable): Showcase your experience in managing loan portfolios, monitoring performance, and mitigating risk.

- Deal Sourcing (if applicable): Highlight any experience in sourcing new investment opportunities, building relationships with potential borrowers, and structuring transactions.

- Investor Relations (if applicable): Emphasize skills in communicating with investors, preparing reports, and managing investor expectations.

- Quantifiable Achievements: Instead of simply stating your responsibilities, quantify your accomplishments. For example, "Increased portfolio returns by 15% through proactive risk management" is more impactful than "Managed loan portfolio."

- Keywords: Financial Modeling, Credit Analysis, Underwriting, Due Diligence, Portfolio Management, Deal Sourcing, Investor Relations, LBO Modeling, DCF Analysis

Tailor Your Resume and Cover Letter

Generic applications rarely impress. Each application should be a bespoke representation of your capabilities tailored to the specific role and firm.

- Keyword Optimization: Carefully review the job description and incorporate relevant keywords from the posting into your resume and cover letter. Use Applicant Tracking Systems (ATS) friendly formatting.

- Targeted Approach: Customize your resume and cover letter to highlight the experiences and skills most relevant to each specific job posting. This shows genuine interest.

- Firm-Specific Knowledge: Demonstrate your understanding of the firm's investment strategy, target markets, and recent transactions. This demonstrates your research efforts.

- Keywords: Resume Optimization, Cover Letter, Job Application, Targeted Resume, Applicant Tracking System

Network Strategically

Networking is invaluable in securing a private credit job. Leverage your connections and expand your reach.

- Industry Events: Attend industry conferences, seminars, and networking events to connect with professionals in the field.

- LinkedIn: Actively engage on LinkedIn, connect with professionals in private credit, and participate in relevant groups and discussions.

- Informational Interviews: Reach out to individuals working in private credit for informational interviews. These conversations can provide valuable insights and contacts.

- Alumni Network: Tap into your alumni network to identify potential connections within the private credit industry.

- Keywords: Networking, LinkedIn, Industry Events, Informational Interviews, Private Credit Networking

Ace the Interview

Thorough preparation is essential for success in private credit interviews.

- Technical Proficiency: Prepare for technical questions related to financial modeling, valuation, credit analysis, and industry knowledge. Practice your calculations and model building.

- Behavioral Questions: Practice answering behavioral questions using the STAR method (Situation, Task, Action, Result). Be ready to discuss past experiences that showcase relevant skills.

- Insightful Questions: Prepare thoughtful questions to ask the interviewer. This demonstrates your genuine interest and initiative.

- Follow-Up: Send a thank-you note after each interview to reiterate your interest and highlight key discussion points.

- Keywords: Interview Preparation, Behavioral Questions, Technical Questions, Financial Modeling Interview, Private Credit Interview

5 DON'Ts for Your Private Credit Job Hunt

Don't Neglect the Fundamentals

A strong foundation in accounting and finance is non-negotiable.

- Accounting Proficiency: Ensure you have a solid understanding of financial statements (balance sheet, income statement, cash flow statement) and accounting principles.

- Financial Ratio Analysis: Be comfortable analyzing financial ratios to assess a company's financial health and creditworthiness.

- Valuation Methods: Understand various valuation methodologies (DCF, comparable company analysis, precedent transactions).

- Keywords: Accounting Fundamentals, Financial Statement Analysis, Financial Ratios, Valuation Methods

Don't Submit Generic Applications

Avoid sending generic resumes and cover letters. Tailoring your application shows genuine interest and attention to detail. This demonstrates respect for the hiring manager's time and increases your chances of getting noticed.

- Keywords: Generic Resume, Generic Cover Letter

Don't Underestimate the Importance of Soft Skills

Private credit roles require strong interpersonal and communication skills.

- Communication: Develop clear and concise communication skills, both written and verbal.

- Interpersonal Skills: Cultivate strong interpersonal skills to build rapport with colleagues, clients, and investors.

- Negotiation Skills: Practice your negotiation skills to successfully structure transactions and navigate complex situations.

- Relationship Building: Focus on building strong relationships with individuals across the organization.

- Keywords: Communication Skills, Interpersonal Skills, Negotiation Skills, Relationship Building

Don't Ignore the Firm's Culture

Research the firm's culture and values before applying. A good cultural fit is crucial for long-term success.

- Company Research: Investigate the firm's website, social media presence, and employee reviews to understand their work environment and values. Ensure your personality aligns with the team's dynamics.

- Keywords: Company Culture, Firm Culture, Work Environment

Don't Be Afraid to Ask for Help

Utilize available resources to enhance your job search.

- Career Services: Leverage career services at your university or professional organization.

- Mentorship: Seek guidance from mentors in the private credit industry.

- Networking Contacts: Reach out to your network for advice and referrals.

- Feedback: Actively solicit feedback on your resume, cover letter, and interview performance.

- Keywords: Career Services, Mentorship, Career Advice

Conclusion

Landing a private credit job requires dedication, preparation, and a strategic approach. By following these five do's and don'ts, you'll significantly improve your chances of success. Remember to thoroughly research the private credit landscape, highlight your relevant skills, tailor your applications, network strategically, and ace the interview process. Don't give up—with persistence and the right strategy, you can crack the code and secure your dream private credit job. Start your journey today by researching available private credit analyst jobs and refining your application materials!

Featured Posts

-

Review Lg C3 77 Inch Oled Tv Pros And Cons

Apr 24, 2025

Review Lg C3 77 Inch Oled Tv Pros And Cons

Apr 24, 2025 -

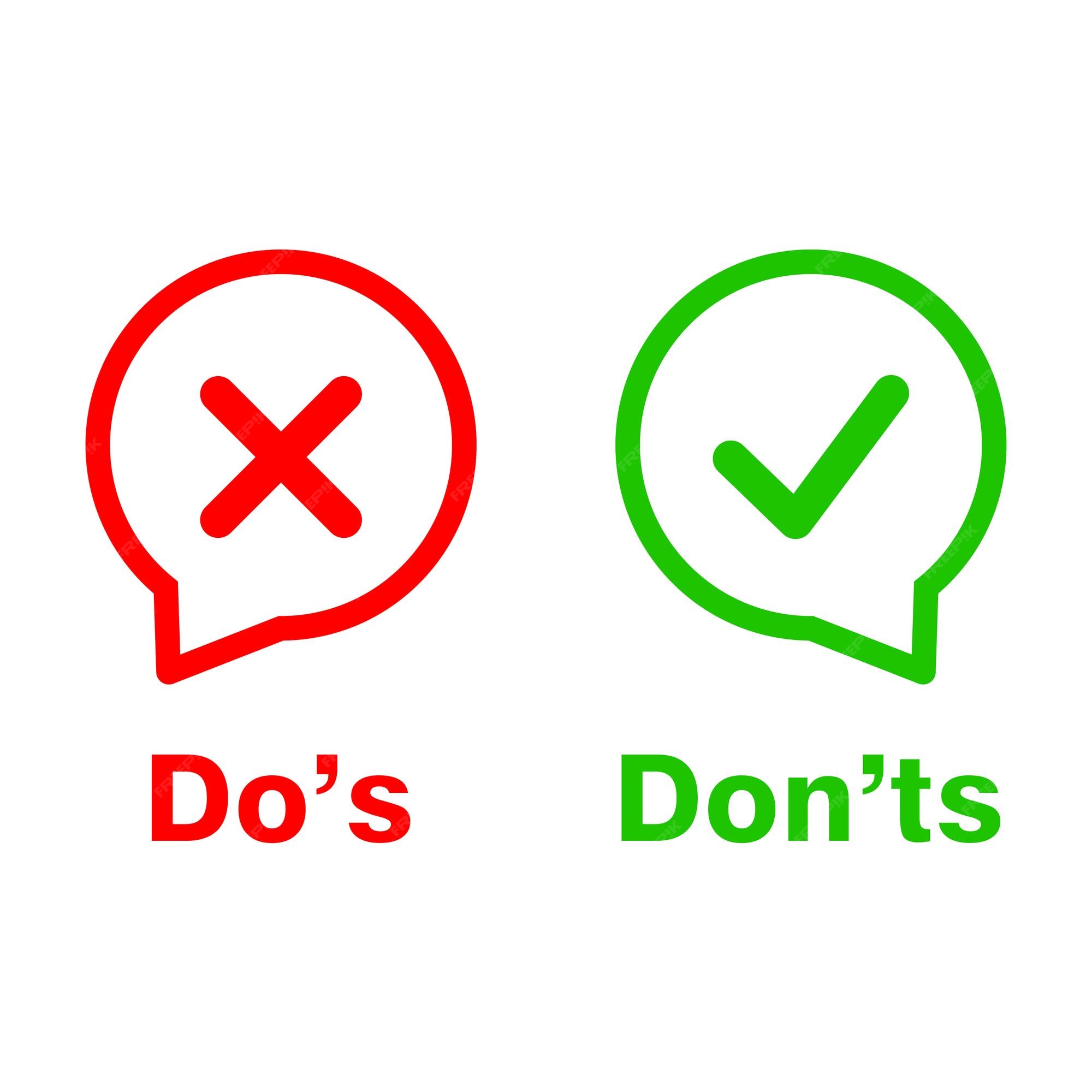

Governor Newsom Addresses Soaring California Gas Prices A Call For Collaboration

Apr 24, 2025

Governor Newsom Addresses Soaring California Gas Prices A Call For Collaboration

Apr 24, 2025 -

Teslas Q1 Earnings Decline Musks Role And Market Reaction

Apr 24, 2025

Teslas Q1 Earnings Decline Musks Role And Market Reaction

Apr 24, 2025 -

Trump Reassures On Powells Position As Fed Chair

Apr 24, 2025

Trump Reassures On Powells Position As Fed Chair

Apr 24, 2025 -

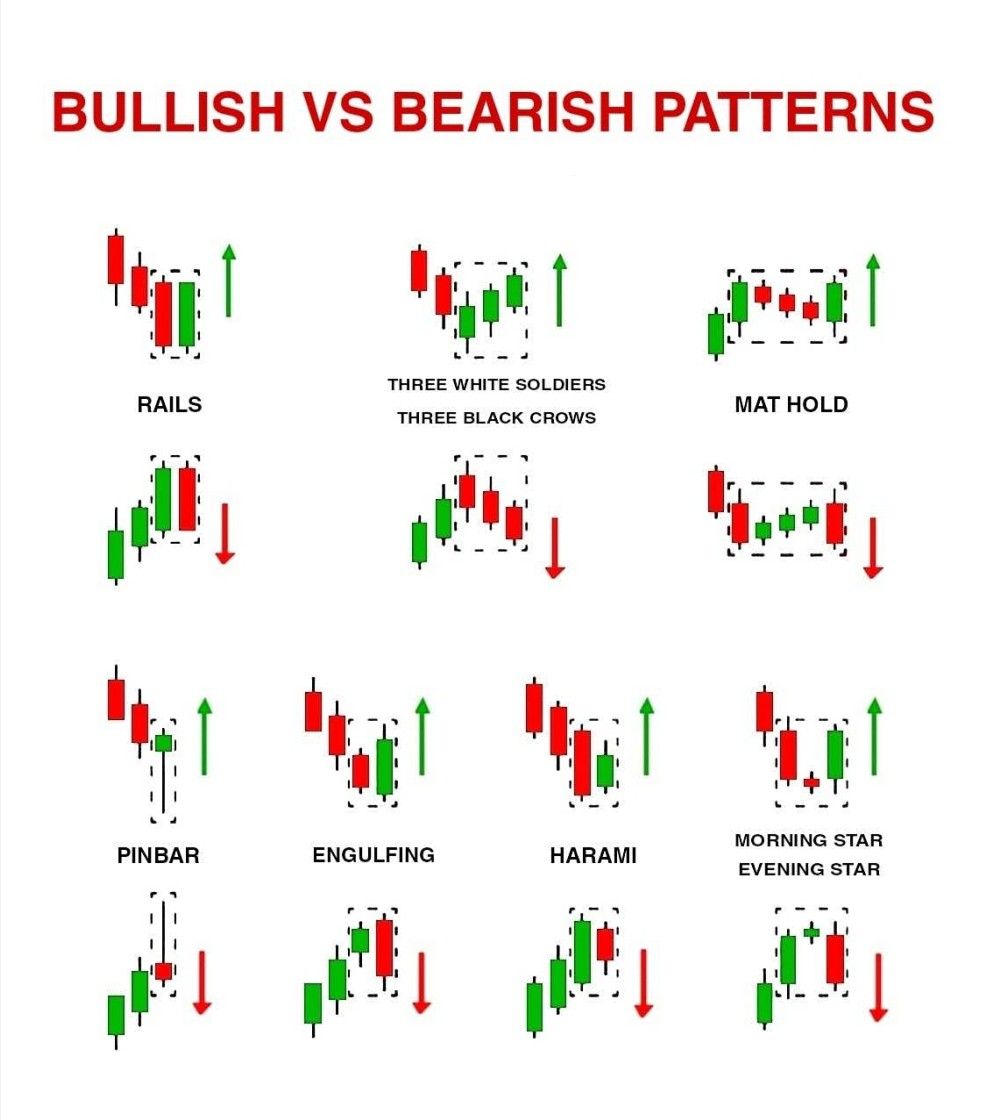

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025

India Market Buzz Niftys Bullish Run Fueled By Positive Trends

Apr 24, 2025