Tesla, SpaceX, And The EPA: How Elon Musk's DOGE Strategy Changed The Game

Table of Contents

The Rise of DOGE and Musk's Influence

Musk's Tweets and Market Volatility

A direct correlation exists between Elon Musk's tweets and the price fluctuations of DOGE. His pronouncements, often cryptic or humorous, have repeatedly triggered significant price swings.

- Example 1: Musk's December 2020 tweet calling DOGE "the people's cryptocurrency" led to a substantial price surge.

- Example 2: Conversely, tweets suggesting he might sell his DOGE holdings have resulted in sharp price drops.

These actions have sparked accusations of market manipulation, raising concerns among regulators. The SEC, for instance, has scrutinized Musk's tweets, highlighting the power of social media to influence cryptocurrency markets and the potential for abuse. The volatility underscores the need for responsible communication from influential figures in the crypto space. Analyzing the impact of his social media posts on DOGE’s price is crucial for understanding the dynamics of this volatile market.

DOGE's Adoption and Mainstream Awareness

Musk's endorsement catapulted DOGE from a niche cryptocurrency to a more widely recognized digital asset. His influence dramatically increased DOGE's mainstream awareness, resulting in:

- Increased user base: Millions of new users joined the DOGE community, drawn by the publicity and Musk's endorsement.

- Significant market capitalization growth: DOGE's market cap experienced massive increases, reflecting its increased popularity and value.

- Acceptance by businesses: Several businesses began accepting DOGE as payment, further solidifying its position in the market. This broadened adoption signifies a significant shift in the cryptocurrency landscape.

Implications for Tesla

Brand Image and Public Perception

Musk's DOGE promotion has significantly impacted Tesla's brand image, eliciting both positive and negative reactions:

- Positive: It appeals to a younger, tech-savvy demographic, associating Tesla with innovation and a forward-thinking approach.

- Negative: Some investors express concern about the potential for financial instability linked to the volatility of DOGE and Musk's unpredictable behavior. Tesla's acceptance of DOGE as payment for some merchandise also raises questions about its long-term financial strategy.

The balancing act between attracting new customers and maintaining investor confidence remains a challenge for Tesla.

Environmental Concerns and the EPA

The EPA's growing concern about cryptocurrency mining's environmental impact creates tension with Tesla's sustainability goals. DOGE mining, like Bitcoin mining, requires significant energy consumption, raising questions about the environmental responsibility of promoting a cryptocurrency with such a high carbon footprint.

- Potential future EPA regulations on cryptocurrency mining could impact Tesla indirectly through its association with DOGE.

- The apparent contradiction between Tesla's commitment to sustainable energy and Musk's promotion of an energy-intensive cryptocurrency poses a reputational risk. Navigating these concerns will be crucial for Tesla's continued success.

SpaceX and Future Funding Models

Potential for Cryptocurrency Funding

SpaceX's potential use of cryptocurrencies, including DOGE, for future funding raises intriguing possibilities:

- Advantages: Cryptocurrency funding could attract a wider range of investors, potentially including those who prefer decentralized finance solutions.

- Disadvantages: The volatility of cryptocurrencies poses a risk, making long-term financial planning challenging. Regulatory uncertainty further complicates the picture.

The use of DOGE or other cryptocurrencies by SpaceX remains largely speculative, but it represents a fascinating area for future development in space exploration finance.

Diversification of Funding Sources

Integrating DOGE into SpaceX's funding strategy could diversify its financial resources, reducing reliance on traditional venture capital or government contracts.

- Comparison: Traditional funding methods are often slower and more subject to bureaucratic processes, while crypto funding offers greater speed and potential for wider participation. However, this comes with the inherent volatility of the cryptocurrency market.

This diversification strategy, although risky, could potentially attract a wider range of investors and provide additional capital for ambitious space exploration projects.

Conclusion

Elon Musk's DOGE strategy has profoundly impacted Tesla, SpaceX, and the regulatory landscape. The market volatility generated by his actions, the resulting shifts in brand image, and the potential for cryptocurrency-based funding models represent a paradigm shift in the intersection of finance, technology, and corporate strategy. The interplay between Elon Musk, DOGE, Tesla, SpaceX, and the EPA underscores the evolving nature of finance and regulation in the age of cryptocurrencies.

The implications of Elon Musk's DOGE strategy are far-reaching and continue to unfold. Stay informed about the evolving relationship between cryptocurrency, corporate giants like Tesla and SpaceX, and regulatory bodies like the EPA. Further research into the impact of this unconventional approach is crucial to understanding the future of finance and technological innovation. Continue the conversation by sharing your thoughts on Elon Musk's DOGE strategy and its long-term effects.

Featured Posts

-

Ted Lassos Revival Brett Goldsteins Thought Dead Cat Analogy Explained

Apr 24, 2025

Ted Lassos Revival Brett Goldsteins Thought Dead Cat Analogy Explained

Apr 24, 2025 -

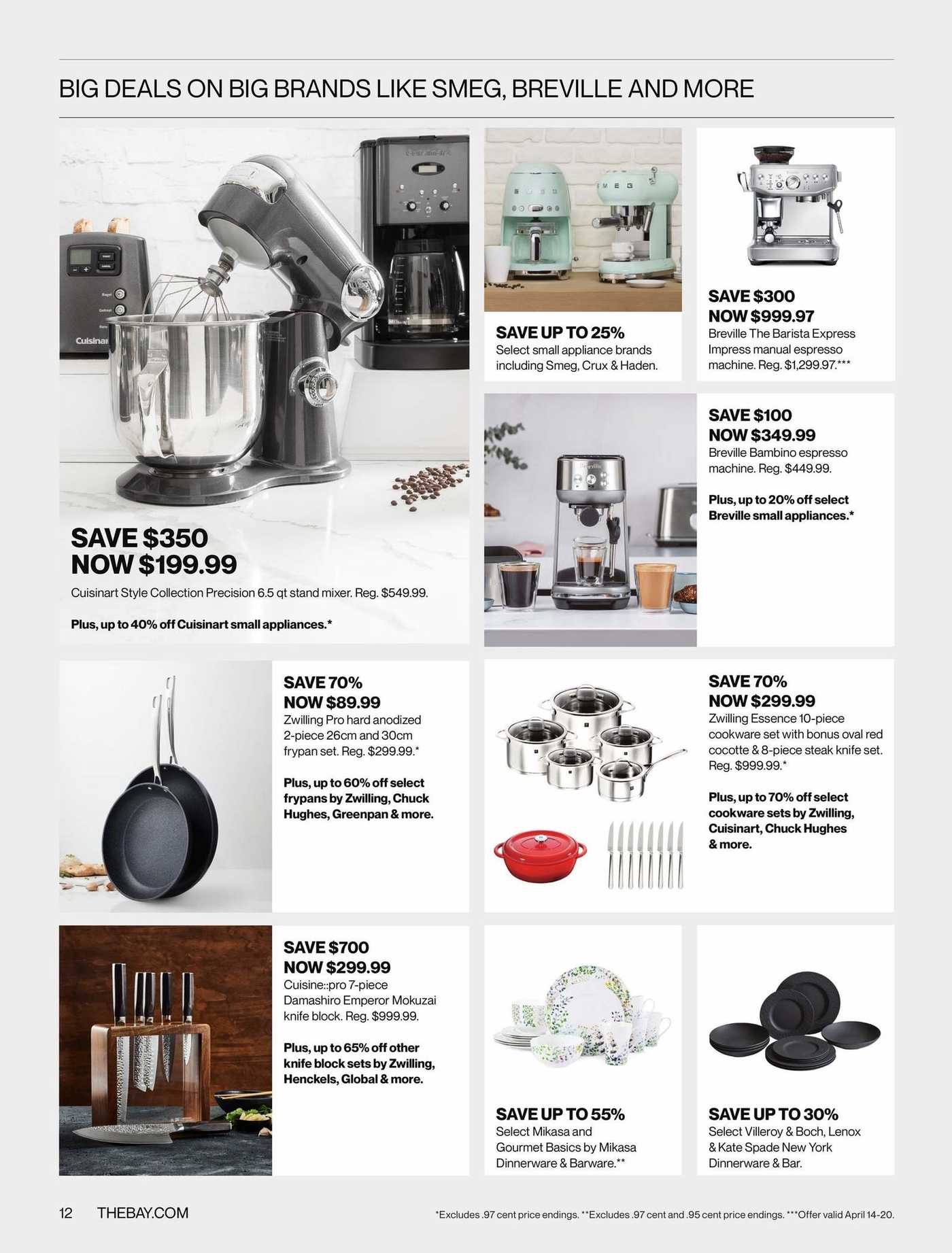

Hudsons Bay 65 Leases Attract Significant Interest

Apr 24, 2025

Hudsons Bay 65 Leases Attract Significant Interest

Apr 24, 2025 -

Building A Fiscally Responsible Canada A Plan For The Future

Apr 24, 2025

Building A Fiscally Responsible Canada A Plan For The Future

Apr 24, 2025 -

Hong Kong Market Sees Chinese Stock Rally Following Trade News

Apr 24, 2025

Hong Kong Market Sees Chinese Stock Rally Following Trade News

Apr 24, 2025 -

Quentin Tarantino Zasto Odbija Gledati Ovaj Film S Johnom Travoltom

Apr 24, 2025

Quentin Tarantino Zasto Odbija Gledati Ovaj Film S Johnom Travoltom

Apr 24, 2025